The Gaming Industry Takes Flight into the Cloud

November 4, 2019

- Author: Kyle Wandel, CTA Manager, Business Intelligence

As the gaming industry prepares for a new generation of consoles, it is transforming how people engage with games, relying more on online gaming services and less on physical gaming discs.

September/October 2019

More articles in this issue:

For several years, the technology industry has been moving towards an increasingly virtual and digital realm as cloud storage, cloud computing and online subscription services have become more readily available to consumers. The video game segment offers a particularly interesting example of how businesses are adapting to new technologies. As the gaming industry prepares for a new generation of consoles, it is transforming how people engage with games, relying more on online gaming services and less on physical gaming discs.

The trend for video game hardware is temporarily in decline due to a slump in shipments for current generation home consoles, such as the PlayStation 4 and the Xbox One S, as consumers patiently await the ninth generation of home console releases from Sony and Microsoft at the end of 2020. Even with strong support for the Nintendo Switch as an all-in-one home/portable console, home console shipments (which excludes shipments of portable video game hardware) are projected to decline 8% from 2018, to roughly 14.8 million total units shipping in 2019.

Paired with the continual double-digit declines in portable console sales (mainly due to the rise in tablet and smartphone gaming), total video game hardware shipments are positioned to decline 9% in 2019 and 11% in 2020. Collectively, gaming consoles will account for over $4.2 billion in shipment revenues in 2019 and nearly $3.9 billion in 2020. However, console revenues look promising pending a successful release of the next-gen systems. Revenues are expected to bounce back to $4.7 billion in 2021.

A New Paradigm

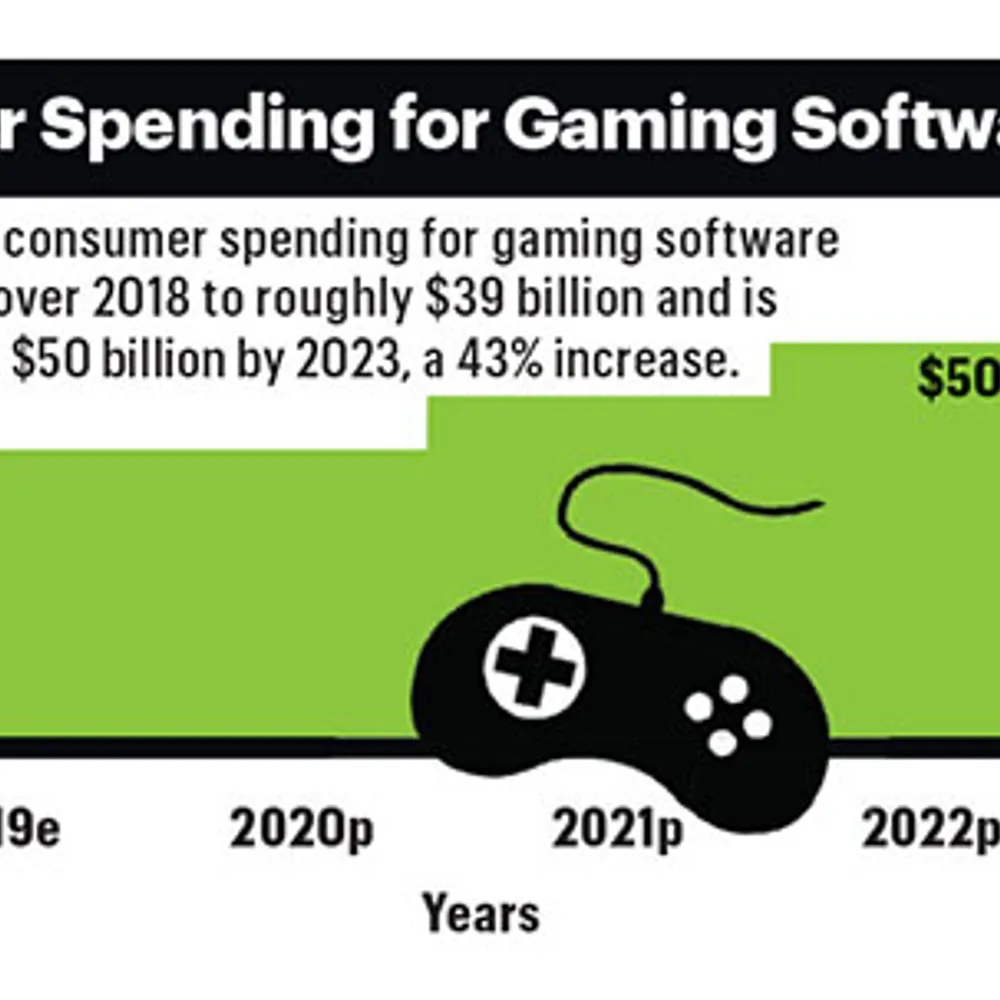

As the gaming industry shifts away from physical media, the entire revenue model for the video game software industry is starting to change. CTA projects that consumer spending for gaming software will increase 11% over 2018 to roughly $39 billion and is expected to reach $50 billion by 2023, a 43% increase. Software growth is attributable to increased spending on in-game purchases, digital gaming downloads and gaming subscriptions— while physical gaming disc revenues will see double-digit declines for the extent of CTA’s five-year forecast.

While physical media and digital downloads have made up the majority of industry revenues in recent years (58% in 2018), in-game purchases and subscription revenues will make major contributions over the next few years. In-game purchases are expected to rise 15% to $12 billion in 2019, as gamers demonstrate that they are willing to incrementally pay for extended game play and enhance their experience with downloadable content.

This year’s announcements from tech giants Apple and Google, entering the game streaming and subscription service market with the debuts of Apple Arcade and Stadia (respectively), will continue to disrupt the traditional revenue stream model for gaming software. For 2019, a 26% year-over-year surge in consumer spending for gaming subscriptions is expected to position it ahead of physical gaming software for the first time. This trend will continue for many years as gaming subscriptions are expected to reach over $10 billion by 2023. Collectively, in-game purchases and subscription revenues will make up 54% of total video game software revenues in 2023, thus turning the table on gaming discs and digital downloads.

The gaming industry is typically one of the first segments to adapt to advances in technology. As consumers continue to embrace technologies such as cloud computing and subscription streaming services, so will the gaming industry.

Join our community of innovators and shape the future of technology.