Health Sensing in Cars

November 19, 2019

- Author: Robert Calem

November/December 2019

More articles in this issue:

To enable future self-driving cars and today’s advanced driver assistance systems (ADAS), automakers have been outfitting vehicles with a growing set of sensors as well as embedded cloud connectivity. Now, another use is emerging for these technologies: detecting the health and wellness of the vehicle’s occupants — both during an uneventful ride or after a major crash.

Health sensing in cars is not a new notion. In the past decade, automakers including Ford showed off concepts ranging from a heart rate sensing car seat to a blood pressure-monitoring steering wheel. But those ideas were never produced due to cost and other factors. So, entrepreneurs turned their attention to finding a more easily implemented alternative, and at least one such invention could be in production as soon as next year.

Liberating Data to Make Money

In 2011, BMW Group collaborated with the Technical University of Munich (TUM) to develop a steering wheel capable of measuring heart rate blood oxygen level and stress level.

Also in 2011, Ford announced it was working on a car seat with six embedded sensors to detect a person’s heart rate, plus Bluetooth tie-ups between its SYNC telematics system and brought-in glucose monitors. Four years later, it dropped the car seat project and pivoted toward integrating wearables brought in to the car for health and wellness tracking.

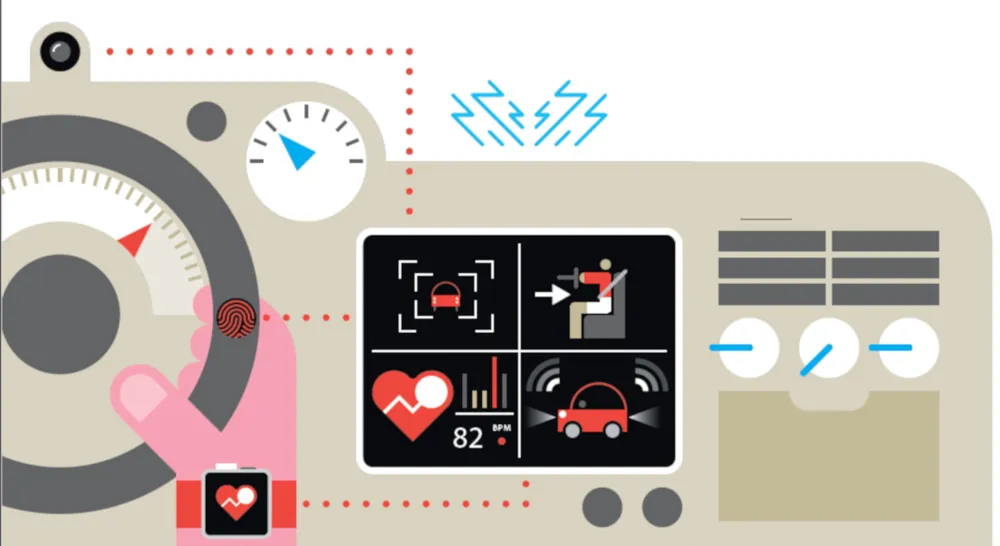

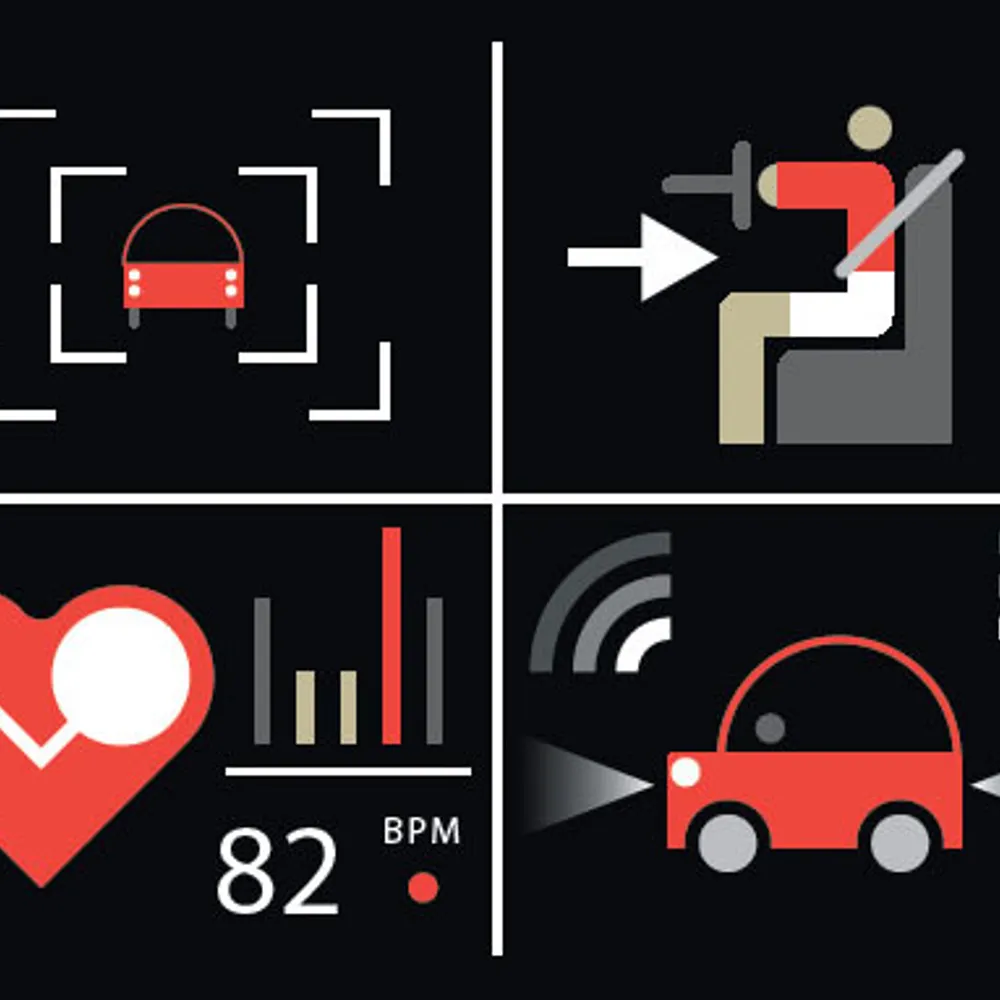

By 2016, Ford’s new Automotive Wearables Experience laboratory at its Research and Innovation Center in Dearborn, MI, was seeking to link a heart-rate sensor in a smartwatch to a vehicle’s adaptive cruise control system. Thus, if a driver’s heart rate sped up with a change in traffic conditions, the vehicle could automatically increase its distance to the car ahead, the company explained at the time.

Automakers’ experimentation with biometric sensors directly put inside vehicles has faded from the forefront, says Sam Abuelsamid, principal analyst at Navigant Research in Detroit. And there are three primary reasons, he says: cost, dependability and regulation.

“We’re already getting into an affordability crunch with new vehicles. It’s harder and harder for people to afford them, which makes it a real challenge to add more technology like this,” Abuelsamid says. “In addition, what may be a bigger factor is making these systems reliable enough” that they don’t give a false positive indicating a health problem or conversely miss something that is happening. “That causes liability concerns,” which are compounded by privacy concerns; a car can have multiple drivers and their data could wind up inadvertently commingled, he says. And lastly, there are regulatory concerns, with some health monitoring systems requiring FDA approval, he adds.

Yet work on biometric sensing has not ceased altogether. Automakers are putting cameras and other sensors in vehicles, initially to ensure drivers are ready to take back control from a self-driving car if necessary (per Cadillac’s implementation with its SuperCruise system). And later, they’ll do it more, to keep an eye on passengers in future-generation robotaxis. Nevertheless, it’s been downplayed “probably in part because [automakers] see it as something that is further off into the future as a viable product offering than they might have thought five years ago,” Abuelsamid says.

“It comes down to the difference between what is possible and what is an actual business, or what’s useful,” says Mike Ramsey, senior research director for automotive and smart mobility at Gartner Inc. in Grosse Pointe, MI. While people don’t care about biometric feedback built into vehicles, for automakers, “the liberation of data from connected cars” is very compelling, Ramsey says. “Taking sensor information and applying it in a way that is very differentiated from what a phone or a smartwatch can provide” is ultimately “the key to connected vehicles becoming a moneymaking business,” he says. And many of those applications remain undiscovered, he adds, noting the proliferation of connected cars will spur development. Gartner predicts 88% of all new vehicles sold worldwide will incorporate connectivity in 2028, with the greatest proportion in the U.S., Japan, South Korea and Europe.

Navigant puts forth a somewhat higher figure: 93% of all new vehicles sold globally in 2028 having embedded connectivity. And it similarly anticipates North America leading the trend, with 90% of new cars here being connected by 2023. Meanwhile, data and analytics firm GlobalData says selfdriving cars will be the fastestgrowing sector of the automobile industry through 2033, with a compound annual growth rate (CAGR) of 76.1% and sales of 11.26 million units. Moreover, the fastestgrowing subset in the timeframe will be Level 5 (fully selfdriving) vehicles, with a CAGR of 73.3%, followed by Level 4 (highly automated) vehicles at 68.6% CAGR.

GlobalData also sees selfdriving robotaxis becoming a mainstream transit option by 2035.

Harnessing Data to Save Lives

“In the future – especially as we enter the autonomous age – a myriad of interior cameras and sensors will be required to monitor passenger health and safety as well as vehicle cleanliness and air quality,” says Craig Piersma, director of marketing at Gentex Corp. in Zeeland, MI. “The vehicle will need to oversee a virtually endless list of potential circumstances. Are passengers and children properly restrained while in transit? Did the correct passengers enter/exit the vehicle at their designated location? Did a passenger smoke, get ill or vandalize the vehicle? Did a passenger leave behind any belongings?”

To deal with these potentialities, Gentex is developing in-cabin systems that monitor passenger activity and well-being along with vehicle hygiene and air quality. In response to the findings, “system intelligence would alter vehicle operation and send alerts and notifications according to detected in-vehicle events,” Piersma explains.

But where systems like Gentex’s fall short is in comprehending the cognitive state of people in the vehicle, contends Carl Pickering, CEO of ADAM CogTec in Portland, OR.

The company is named after its Adaptive Driver’s Attention Management system, which flashes white LED lights in the driver’s peripheral vision field and analyzes physiological responses to the visual stimulus: eye saccades, pupil dilation and eyelid position, in addition to other ocular parameters. Tests are done at the start of a drive and periodically henceforth, so changes over time can be traced. And if the results signal impairment, Pickering says, the vehicle’s ADAS technologies can initiate preventative measures to avert potential accidents.

“Understanding [the driver’s] cognitive state is critical since the vast majority of car accidents are due to human error, and the root cause of most human error is cognitive impairment and misallocation of cognitive resources — more commonly referred to as driver inattention,” he says.

ADAM DETECT, the company’s product, can distinguish among impairments caused by alcohol, drugs, extreme fatigue and “cognitive absorption” (a wandering mind), Pickering says. In lab testing, it also has been proven 95% accurate with regard to alcohol impairment, as correlated to breathalyzer results, he states. Since it’s essentially a software solution — leveraging the same camera employed for other driver monitoring systems — it can be easily added to any current vehicle, he declares.

Pickering formerly was head of autonomous technology strategy and global HMI (human-machine interface) manager at Jaguar Land Rover, for which he worked more than 20 years in the U.K. He joined two-year-old ADAM CogTech at the end of 2018 because he was bullish on the technology and the promise it holds, he says.

He expects ADAM DETECT to be in a commercially available vehicle by the end of next year. To date, ADAM CogTech has a deal in place with one automotive industry supplier and more pending with at least two others, he reports.

Post-crash, internal injuries to the driver and passengers aren’t visible but can be life-threatening, nonetheless. This is the context for medical connected services technology from MDGo, an Israeli startup that was a first-time exhibitor at CES last year.

Analyzing crash data routinely collected by a car’s sensors and electronics infrastructure in real-time, MDGo’s software deduces the impact of a collision on a person’s internal organs, head, neck, chest and pelvis, then extrapolates the injuries they may have sustained. It then uses the vehicle’s embedded connectivity to send a message alerting emergency medical responders and local hospitals to these possibilities, allowing them to figure out their best course of action before arriving at the scene.

A pilot test of MDGo’s technology in Israel, begun last year in conjunction with the country’s Magen David Adom national ambulance service, has shown 92% medical report accuracy compared to MDA’s reported findings from more than 120 crashes, says Gilad Avrashi, the company’s co-founder and chief technology officer. Another pilot, in Michigan, is anticipated to begin in 2020.

Join our community of innovators and shape the future of technology.