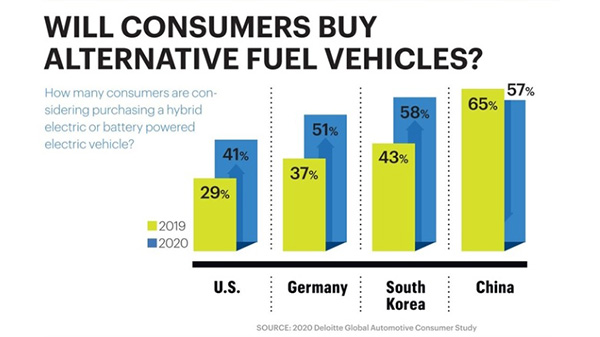

Indeed, the 2020 Deloitte Global Automotive Consumer Study found 41% of U.S. consumers are considering purchasing an alternative fuel vehicle in the future, such as a hybrid electric or battery-powered (fully) electric vehicle up from 29% last year. In Germany it’s up to 51% from 37% last year, and in South Korea it’s up to 58% from 43% in 2019. But EV purchase intent has declined in China, to 57% from 65% year-over-year. The study included surveys of 35,000 online driving-aged consumers in 20 countries.

However, Deloitte says 48% of U.S. consumers believe that self-driving cars may be unsafe and 68% believe self-driving commercial vehicles could be a menace on highways. More, 34% of U.S. consumers are not willing to spend extra money for self-driving tech in a car and among those who are willing, most peg their maximum at $500, which doesn’t cover the costs of the technology, Vitale notes. Likewise, 31% of U.S. consumers won’t pay more for safety-oriented V2X (vehicle-to-vehicle or vehicle-to-infrastructure) communications technology, the Deloitte study found. This sentiment was higher among German consumers (46%), though lower among Japanese (28%).

According to a report by KPMG LLP titled Automotive Semiconductors: The New ICE Age, the market value for semiconductors used in automobiles will grow from $40 billion in 2019 to more than $200 billion by 2040. The report states, “this growth will be led by uses in advanced driver assistance systems, infotainment and telematics, and electric powertrains. Autonomous driving will require both ADAS and telematics sub-applications for safe operation. With riders’ attention freed from driving, passengers in self-driving vehicles are expected to spend the time using more advanced and expensive in-vehicle infotainment systems, spurring the growth of infotainment applications.” KPMG forecasts that chips for ADAS, infotainment, telematics and EVs could capture 8% of the automotive semiconductor market by 2040, up from 45% last year.

Car buyers are mostly interested in their in-vehicle experiences, says Deloitte’s Vitale. “Those [automakers] that are providing the better [HMIs] are the ones that are able to get premiums for their vehicles,” he says.

To this end, microcontroller maker Cypress Semiconductor demonstrated at CES its new Traveo II, which supports in-cabin displays that show Full HD video resolution. It will be in cars early next year, says Sven Natus, senior director of the automotive business unit, for microcontrollers and software at Cypress in San José, CA

Ainstein announced a millimeter wave radar-based alternative to the kick sensors now used on many vehicles for automatic trunk activation and announced a joint venture with ADAC Automotive (an auto industry Tier 1 supplier) to design, develop and manufacture the product. The joint venture company, named RADAC, demonstrated the patent-pending solution at CES expected by the second quarter of this year as a new Tier 1 supplier.

Bosch won a CES 2020 Best of Innovation award for its Virtual Visor, which links an LCD panel in front of the windshield with a driver or occupant-monitoring camera to track the sun’s casted shadow on the person’s face. The system then uses AI to darken only the portion of the visor where the sun is hitting the driver’s eyes, leaving the rest of the display transparent for an improved field of vision. Bosch also is a CES 2020 Innovation Award winner in the vehicle intelligence and transportation category for its new 3D Display. It uses passive 3D technology (no need for glasses) to generate three-dimensional images and warning signals on the instrument cluster, which Bosch says speeds driver cognition.

Continental received a CES 2020 Innovation Award in the vehicle intelligence and transportation category for its Transparent Hood technology. It uses four outside cameras and image processing to let the driver see terrain and obstacles usually obstructed by the car’s front end. The company also teamed with Sennheiser to present an audio system without speakers. It includes Continental’s Ac2ated Sound system which excites select surfaces in the cabin to produce sound as well as Sennheiser’s AMBEO 3D audio technology. The weight and space savings achieved with Ac2ated Sound —up to 90% versus conventional sound systems —makes it ideally suited to EVs, which can gain range from the difference, Continental says.

Elektrobit demonstrated the convergence of camera-based gaze detection with Amazon Alexa in a vehicle, to enable greater personalization of car features.

Futurus Technology is a CES 2020 Innovation Awards Honoree in the in-vehicle and entertainment category for its light field head-up display. It projects two distinct screen fields layered on top of one another. The first, about 1.5 meters in front of the driver and sized at 25-inches, is for instrument cluster and navigation information plus infotainment content; the second, appearing to be 50 meters away and about 390-inches big, provides an augmented reality (AR) view of the world. It is expected to be ina production vehicle from a Chinese automaker in 2022, says Alex Xu, founder and CEO of the Beijing, China-based company.

Intuition Robotics announced a collaboration with Toyota to integrate its “Q Engine” cognitive AI platform in a forthcoming sedan. The technology will create an in-vehicle “proactive not reactive” digital assistant that aims to achieve specific outcomes and recommend specific actions. “It’s not just driving and giving voice commands to an assistant. It’s much more of a collaborative experience, where the car is a teammate of sorts,” explains Dor Skuler, CEO of the Tel Aviv, Israel-based company.

Ouster is a CES 2020 Innovation Awards Honoree in the vehicle intelligence and transportation category for its new OS2-128 long-range LiDAR sensor. The size of a coffee mug, it has a range of more than 240 meters, a high 128-channel resolution, and is intended for high-speed driving applications. Ouster also introduced the OS0-128, a 128-channel LiDAR sensor with an ultra-wide, 95-degree field-of-view.

Pioneer showed five new CarPlay and Android Auto receivers at CES, including the DMH-WT8600NEX, a 10.1-inch model with a 720p capacitive touchscreen. The display hovers over the dashboard, allowing a traditional single-DIN chassis with no custom installation needed. It supports both wired and wireless CarPlay.

Valeo demonstrated VoyageXR and CallXR, two systems that leverage a vehicle’s ultrasonic sensors, cameras inside and outside, connectivity and machine learning algorithms. VoyageXR allows a person located anywhere in the world to virtually see inside the vehicle’s cabin and through its windows, and have a conversation with the driver, taking on the guise of an avatar visible in the rearview mirror. The remote individual interacts via a virtual reality (VR) headset and joystick. Valeo calls this the world’s first immersive communication system for vehicles. With CallXR, the remote individual uses a smartphone or tablet in lieu of the headset and joystick and can interact with the driver. Valeo compares this experience to a video conference call system. XR is Valeo’s acronym for “cross-reality.”

Velodyne introduced a tiny, very inexpensive LiDAR sensor named Velabit aimed at ADAS applications. Smaller than a deck of cards and priced at $100 each, the Velabit offers a range up to 100 meters and a 60-degree horizontal field-of-view. It can be mounted in the cabin (behind the windshield), or in the side mirrors, bumpers or front grill, and is useful for automatic emergency braking, pedestrian and bicyclist detection, blind spot monitoring and cross-traffic detection, says Anand Gopalan, CEO of Velodyne Lidar Inc. based in San José, CA. The Velabit is expected to be in a production car in about two years, Gopalan says.

Visteon showcased new display technologies as well. One, called MicroZone, is a modified LCD screen incorporating patented innovations that yield added contrast, making it comparable to an OLED screen but at a lower cost, says Upton Bowden, advanced technology product marketing director at the company, based in Van Buren Township, MI. It also showed a display with an integrated hinge that can flex and bend, to either wrap around the driver or unfold for showing content to passengers and new display forms, including convex displays, which let auto designers be more creative.

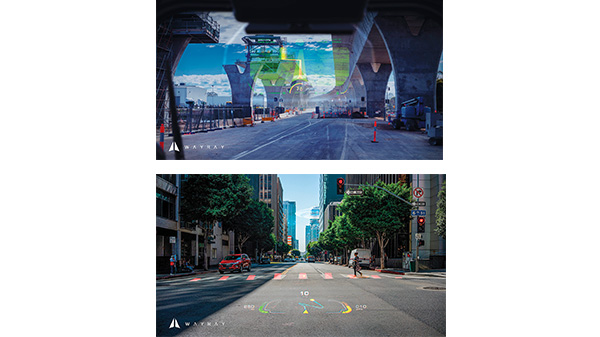

WayRay, a Zurich, Switzerland-based competitor to Futurus, unveiled the first full-spectrum color holographic AR display for infotainment in self-driving cars. This follows WayRay’s CES 2019 demo of its 180-degree Holographic AR Cockpit. Full-spectrum color was made possible by the addition of a blue laser to the display.

Yank Technologies showed its solution for over-the-air wireless charging of smartphones or tablets anywhere in a vehicle’s cabin using strategically placed antennas. These could be in cupholders and in seat cushions says Josh Yank, co-founder of the Brooklyn, NY-based company. The company’s technology also could be used in EVs to replace wiring harnesses, thus saving weight and increasing driving range, Yank says.

“From our perspective, the passenger car industry adoption of LiDAR is probably in the 2023-2024 timeframe” or later, because most automakers have delayed their introduction of vehicles that would use the long-range, front-facing sensors by a couple of years, observes Frantz Saintellemy, President and COO of leading LiDAR sensor maker LeddarTech Inc., based in Quebec City, QC, Canada. One reason is a lack of readiness for the complexity of integration, but also no suppliers yet offer a long-range LiDAR sensor that is automotive grade and meets the performance and cost requirements necessary for adoption in passenger cars.

At CES 2020, LeddarTech introduced a LiDAR sensor tailored to self-driving robot shuttles, commercial and delivery vehicles: the “cocoon-style LiDAR” features a wide 180-degree field-of-view and 50-meter range, and is priced at $2,500 or less. The company believes delivery vehicles will be deployed with the technology sooner than personal automobiles. Even for automotive ADAS applications, “you need to get to sub-$500 per LiDAR,” Saintellemy says. “Over the next four to five years, what’s being deployed are these mobility vehicles.”

LiDAR maker AEye featured its LiDAR technology, which fuses a high-definition camera and a software-definable “agile LiDAR” whose scan pattern can be altered, to form a vision system that can “mimic the human visual cortex,” says Steve Lambright, vice president of marketing at AEye Inc., in Pleasanton, CA. The point is to enable a vehicle to react faster to objects in its path and, with computing power built into the sensor, predict the path an object such as a pedestrian. The included LiDAR sensor is based on a fiber laser instead of the more common solid-state variety. The company also plans to offer a RGB or thermal imaging cameras to pair with it. Will consumers buy alternative fuel vehicles? How many consumers are considering purchasing a hybrid electric or battery powered electric vehicle?

I3, the flagship magazine from the Consumer Technology Association (CTA)®, focuses on innovation in technology, policy and business as well as the entrepreneurs, industry leaders and startups that grow the consumer technology industry. Subscriptions to i3 are available free to qualified participants in the consumer electronics industry.