At the same time, the details of 2020 life have raised many questions. How do you factor the significance of this data point: WFH employees say they encounter 43 minutes of interruptions per day versus 78 minutes daily when they’re in the office? What about the capability to set up virtual private networks (VPNs) to assure greater security for important communications or the ability to interact with B2B vendors? And will this summer’s boom in low-priced computer sales — presumably for at-home schooling — lead to future upgrades?

To the great joy of many communications providers and regulators, the telecom infrastructure has held up well, despite 20% to 40% jumps in daytime digital traffic (both from work- and school-related activities plus at-home entertainment video streaming). Monitoring services have occasionally spotted slowdowns in broadband speeds (varied by time and town), but overall high-speed connections have held up. The big remaining problem, as the Federal Communications Commission (FCC), Congress and many public-interest groups continue to complain, is that rural and underserved urban areas are not sufficiently on the broadband highway, unable to tackle at full strength the WFH, school and other opportunities.

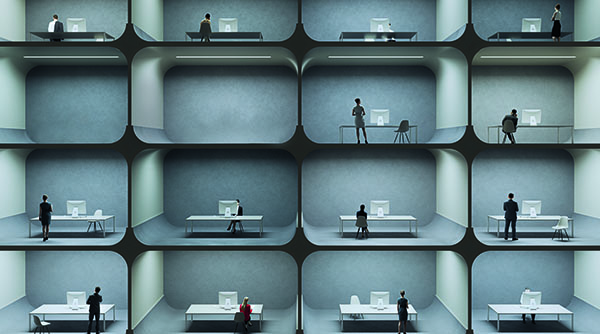

Add in the reality of white-collar jobs — a combination of individual work plus group meetings. According to Global Workplace Analytics, which has been monitoring telework for more than a decade, people in an office spend about 58% of their time in solo tasks and 42% working with others.

Nonetheless, teamwork is one of the core issues in the post-COVID-19 environment. Collaborative software is at the heart of the current WFH opportunity, says Kate Lister, president of Global Workplace Analytics, a Carlsbad, CA research firm. She points out that companies which had not “gone to the cloud” or adopted remote digital storage “had the most trouble” in the quick COVID-19 transition.

Predictably, “security” is a major consideration in the quick move to teleworking. Companies had used “security risks” as an excuse for prohibiting distance working, Lister says, but notes that COVID-19 accelerated the adoption of VPNs and other tools to allow employees to work from home. GWA’s latest study a couple months ago, when compared to its longitudinal reports from recent years, shows the swift uptake of WFH activity since the COVID-19 era began.

“More companies began equipping employees with laptops with built-in security software, requiring and making sure the computers are locked down and can only be used for certain things,” she says, noting that often means the company computer can only be used for business activities.

Ignoring such security risks is a “false economy,” Lister says. “Avoiding one security breach is worth however much you have to pay for better equipment.”

Several reports — both quantitative and anecdotal — have acknowledged the "improved environment" since the COVID-19 lockdowns, with reduced air pollution as fewer cars were on the roads. One study tracked a 25% to 50% decline in nitrogen dioxide levels (depending on the region) and another identified significant reductions (up to 11%) in particulate matter (PM2.5) in areas where business closed down. The World Economic Forum, however, warns that these reductions "will do little to address the issue of air pollution in the long run."

Whatever becomes of that process, for now, experts extol the idea that by discouraging single-passenger auto trips (such as commuting), companies can provide community services by enabling better air quality. Coming amid the climate change debate, the COVID-19 crisis has also triggered extensive discussions about how both issues should be addressed simultaneously.

"The crisis of the pandemic is highly related to the crisis of climate change and to the economic crisis," said David Benjamin, a Columbia University associate professor of architecture and founder of a design group focused on biological solutions. In an extensive Washington Post examination of COVID-19's impact on architecture, Benjamin said, "We must address all three together." Others sum up that view as abandoning LeCorbusier's century-old manifesto that buildings are a machine, replacing it with a vision of future buildings as living organisms — not merely "green structures" but an entirely new type of construction for future healthful living and working.

The retailer, following the recommendation of its supplier Nationwide Marketing Group, expanded its use of Podium, an interaction management platform that can manage customer contacts and billing. Brenner says it provided “additional channels of communication and sales with our customers.”

“This has opened up many sales opportunities that we may not have had the ability to obtain previously,” he says.

“Inventory management remains a major issue,” says Brenner, citing the need to keep in touch with distributors to assure a flow of “go-to items” that customers want. He says that some categories have seen constrained inventory, often because of global production supply chains that have restricted parts and component delivery.

Customers are using the COVID-19-induced time at home to have work done at their houses, Brenner says. Keeping the contractor connections has become even more vital — despite the occasional hiccups from inventory lapses.

Similarly, Schaefer’s Inc., an electronics and appliance retailer in Lincoln, NE, closed for about two weeks in April, continuing to sell products online with a skeleton crew at the store handling customer calls and a small office staff working limited hours, explains Ron Romero, president of the family-owned store. Schaefer’s closed the 40,000 square foot showroom to protect the staff, not because of local requirements.

“It gave us time to prepare our store, deep clean and repaint,” Romero says. It also protected the 70-member staff. One challenge initially was getting maintenance supplies. During the interim, Romero focused on ways to expand the store’s e-commerce capability, which was already in place, plus designing delivery tactics for its staff and contract employees.

“The biggest challenge was in delivery,” says Romero, citing the need “to take more precautions” when entering customers’ homes. “They were very cautious” on both ends — assuring that the staff was healthy and questioning customers to make sure that delivery teams would not be at risk entering homes.

Romero, who is a director of the Nationwide Marketing Group, is satisfied that business is returning to “normal,” but notes that many retailers believe that the “biggest problem is getting product because domestic and foreign manufacturers are shutting down or cutting back factories.”

Nationwide Marketing Group, which provides buying, marketing and operational support services to 5000 independent retail members (including Schaefer’s and Silica For Your Home), has embraced collaboration software, according to Frank Sandtner, executive vice president of Business Services. NMG has extended use of the technology to reach its “very distributed workforce,” he says.

“COVID-19 accelerated our use of Microsoft Teams internally and we started to recognize many of our other partners and vendors were using Teams as well. So, our use of video has expanded to our vendors in doing monthly and quarterly review calls.”

Patrick Maloney, NMG’s senior vice president of merchandising, focuses on the speed with which the company “moved and adapted to a remote operation model.” NMG had been using videoconferencing for nearly two years and “found it quite successful, specifically for those working remotely.”

“When COVID-19 hit, we were in a unique position that allowed us to quickly accelerate the adoption of these platforms,” Maloney says. “The challenge was our extended touchpoints,” requiring focus on consumer demand, where “operating procedures demanded a 180-degree change almost overnight.” He describes “the things that make independent retailers unique,” such as the assisted in-store experience and advanced product knowledge.” The NMG digital team focused on creating “a virtual environment that comes close to duplicating the in-store experience online,” such as texting services, online chat and video chat, Maloney says.

Sandtner explains, “We quickly realized that the fundamental nature of person-to-person interactions has changed,” citing especially the move to far fewer and shorter face-to-face interactions. The shift away from personal interaction “involves more training for our field team on the services we offer and very targeted interactions with our members.”

Ingenuity has become part of the COVID-19 business evolution. The Conference Board, in its reports on “Human Capital Response to the COVID-19 Pandemic,” concludes that increased remote working “could become the most influential legacy of COVID-19.” It acknowledges that workforce reductions are “more likely among industry and manual service workers” than among professional workers, who “are more likely to have unique skills or institutional knowledge.”

The Conference Board’s studies also found overwhelmingly organizations are now focusing on workforce health and office safety.

McKinsey & Co., in its series of B2B analysis of COVID-19’s impact, contends that “the next normal” will see unending adaptations as businesses explore new ways to operate. For example, it sees a doubling in the customer preference for digital relationships rather than traditional interactions. Its latest survey showed a pivot toward remote selling, with 96% of B2B sales teams fully or partially shifted to digital sales — largely fueled by the necessity to use it as the “only” way to reach prospective customers. Nearly 80% of the B2B companies that McKinsey surveyed said they are likely to sustain those digital shifts for at least 12 months — and maybe forever — post-COVID-19.

Or looking at it from a slightly different perspective, Patrick Maloney of Nationwide Marketing Group sums up the lessons of the rapid response to COVID-19 crisis as making the tech industry “significantly more resilient.”

CTA’s twice-yearly U.S. Consumer Technology One-Year Industry Forecast found spending on streaming and software services including audio, video and video gaming have risen amid stay-at-home orders, and are projected to reach a record high of $86 billion in 2020 (14% growth over last year).

Several reports — both quantitative and anecdotal — have acknowledged the "improved environment" since the COVID-19 lockdowns, with reduced air pollution as fewer cars were on the roads. One study tracked a 25% to 50% decline in nitrogen dioxide levels (depending on the region) and another identified significant reductions (up to 11%) in particulate matter (PM2.5) in areas where business closed down. The World Economic Forum, however, warns that these reductions "will do little to address the issue of air pollution in the long run."

Whatever becomes of that process, for now, experts extol the idea that by discouraging single-passenger auto trips (such as commuting), companies can provide community services by enabling better air quality. Coming amid the climate change debate, the COVID-19 crisis has also triggered extensive discussions about how both issues should be addressed simultaneously.

"The crisis of the pandemic is highly related to the crisis of climate change and to the economic crisis," said David Benjamin, a Columbia University associate professor of architecture and founder of a design group focused on biological solutions. In an extensive Washington Post examination of COVID-19's impact on architecture, Benjamin said, "We must address all three together." Others sum up that view as abandoning LeCorbusier's century-old manifesto that buildings are a machine, replacing it with a vision of future buildings as living organisms — not merely "green structures" but an entirely new type of construction for future healthful living and working.

I3, the flagship magazine from the Consumer Technology Association (CTA)®, focuses on innovation in technology, policy and business as well as the entrepreneurs, industry leaders and startups that grow the consumer technology industry. Subscriptions to i3 are available free to qualified participants in the consumer electronics industry.